philadelphia transfer tax regulations

Subcode PM was further amended. November 13 2000.

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

Suite 1100 Philadelphia PA 19103 Phone.

. Long-term leases 30 or more years Easements. Subcode PM was repealed and replaced by Bill No. Get city of philadelphia real estate transfer tax regulations PDF file for free from our onlin CITY OF PHILADELPHIA REAL ESTATE TRANSFER TAX REGULATIONS MIGFKFBDPX PDF 70 Pages 3647 KB 27.

The Philadelphia realty transfer tax rate is currently 3 but will increase on January 1 2017 to 31. Common transactions that are excluded from real estate transfer tax include. Since AVI the Philadelphia CLRF has been close to 100.

And currently it is 101. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Amendment to the Real Estate Transfer Tax Regulation 12-10-21pdf.

Sugar-Sweetened Beverage Tax Regulationspdf. Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate including contracted-for improvements to property transferred by deed instrument long-term lease or other writing. The aggregate transfer tax for transactions throughout most of Pennsylvania is.

Both grantor and grantee are. Philadelphias transfer tax is one of the highest rates within Pennsylvania. Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1 for a total of 4278.

Documents showing ownership include. Previously a real estate company owed Philadelphia transfer tax upon a 90 or more change of ownership within a three-year period. Effective July 1 2017 a real estate company is treated as an acquired real estate company and owes Philadelphia transfer tax upon a 75 or more change of ownership in the company within a six-year period.

Pennsylvania imposes a 1 transfer tax on the value of the real estate being transferred while Philadelphia imposes a 3278 tax on the value of the real estate being transferred. Comments and Suggestions Concerning Notice of Proposed Rulemaking Department of Revenue 61 Pa. 233 409 A2d 326 328 1979.

519 rows AMENDMENT TO THE REAL ESTATE TRANSFER TAX REGULATIONS. If there are any questions that a resident may have they can reach out to the Philadelphia Sheriffs. This transfer tax is traditionally split between the buyer and the seller with each party paying half and becomes payable when the property deed or another document showing ownership is filed with the Record of Deeds.

In a corporate dissolution there is no realty transfer tax on the transfer of realty from the corporation to the trustees for the stockholders. Instead of imposing Philadelphia Realty Transfer Tax when a real estate company experienced a 90 percent or more change in ownership in a three-year period transfer tax is imposed when a real estate company experiences a 75. It has changed the ownership interest that will trigger the transfer tax from 90 to 75 with a six year waiting period.

Philadelphia transfer tax law excludes 28 transactions while Pennsylvania transfer tax law excludes 34 transactions. Office of Chief Counsel. Tax on the Transfer of Real Estate There is a 2 percent Transfer Tax on all property sales in Pennsylvania 1 percent to the state and 1 percent to the municipality and school district based on the value of the property or interest that is being transmitted.

215 893-9300 Fax. The tax becomes payable when a property deed or other document showing realty ownership is filed with the Records Department. Electronic version of The Philadelphia Code and Home Rule Charter is current through May 8 2022 with links to recent amendments current through June 10 2022.

Philadelphia Beverage Tax Regulations - Amendments to Section 101 and 401. Effective July 1 2017 Philadelphia law changed. Philadelphia Code 19-1405 Under the new provision a 75 change in ownership will be deemed to have occurred if within six years of one or more prior transfers.

Current Transfer Tax Rules. Department of Public Health. The Sheriffs Office will also continue to host food giveaways and virtual town halls to answer any questions that residents may have.

120647 approved January 20 2014 and effective July 1 2015. Ad Download Or Email Form 82-127 More Fillable Forms Register and Subscribe Now. This transfer tax is traditionally split between the buyer and the seller with each party paying half and becomes payable when the property deed or another document showing ownership is filed with the.

The Realty Transfer Tax applies to the sale or transfer of real estate located in Philadelphia. However this is not always the same as the sales price. For comparison Montgomery County Pennsylvanias transfer tax is only 1.

Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1 for a total of 4278. Transfer tax payable to the Commonwealth of Pennsylvania is an additional 1 making Philadelphias combined transfer tax rate 41. Transfers to an excluded party by gift or dedication confirmation deeds correctional deeds transfers between certain relatives transfers between certain non.

The new Pennsylvania Transfer Tax Regulations would assess a tax on the transfer to the intermediary and a transfer from the intermediary creating two transfer taxes where only one tax existed prior to the new regulations. Code Chapter 91 Realty Transfer Tax RTT Realty Transfer Tax. Philadelphias new ordinance seeks to close the loophole for 8911 transactions.

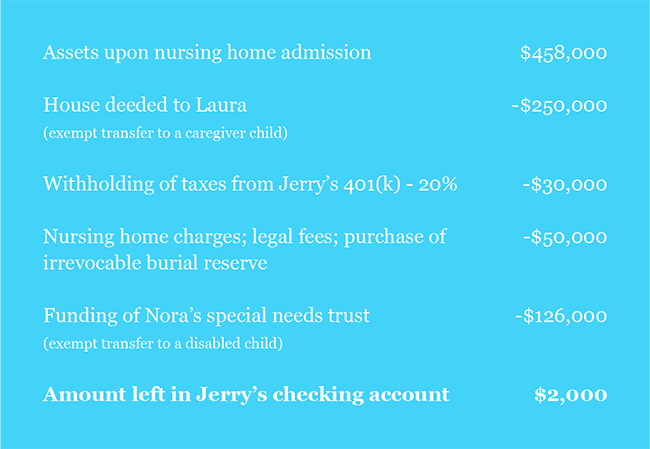

Gifts Can Create Ineligibility For Pennsylvania Medical Assistance Medicaid Long Term Care Benefits Robert C Gerhard Iii

How To Spend Down To Qualify For Medicaid Eligibility In Pa

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

What You Need To Know About Philadelphia S Tax Abatement Program The Legal Intelligencer

Is Your Real Estate Transaction Subject To Philadelphia Real Estate Transfer Tax Legal Insights Real Estate Law High Swartz Llp

Get Paypal Transfer Western Union Transfer Bank Transfer Moneygram Transfer Logins Cctop Up Western Union Money Transfer Western Union Money Market Account

Healthcare Provide Compliance Cms Price Transparency Rule

St Louis Based Pretium Packaging Lays Off Hundreds Of Workers As It Closes 5 Plants Transfers Work St Louis Business Journal

Like Kind Exchanges Of Real Property Journal Of Accountancy

Pennsylvania Property Tax H R Block

Effective Practices That Support Transfer Students

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Pennsylvania Real Estate Transfer Taxes An In Depth Guide

Philadelphia Real Estate Market Crunched By Low Home Supply And Price Inflation Will See The Return Of 10 000 Grants For First Time Buyers Phillyvoice